Fox Business Full Interview – Bruce Hosler

Bruce Hosler’s full interview on Moving To Tax-Free with Tom Hegna, the legendary host of Fox Business Television. Bruce Hosler, a financial advisor, and author, shares his journey from a tax accountant to a financial advisor, emphasizing the importance of planning for future tax implications in investments and retirement. Bruce is the author of “Moving to Tax-Free.” Industry legend Tom

#44 | BONUS – David McKnight on The Power Of Zero in 2024

Financial Market Quarterly Commentary | March 2024

Market Update—Quarter Ending March 31, 2024 Presented by Bruce Hosler — Quick Hits Strong Start to the Year for Stocks A positive March for stocks caps off a solid first quarter. Mixed Quarter for Bonds Bond returns were mixed due to rising rates in the quarter. Healthy Economic Growth First-quarter economic reports show signs of healthy growth. Inflation and the

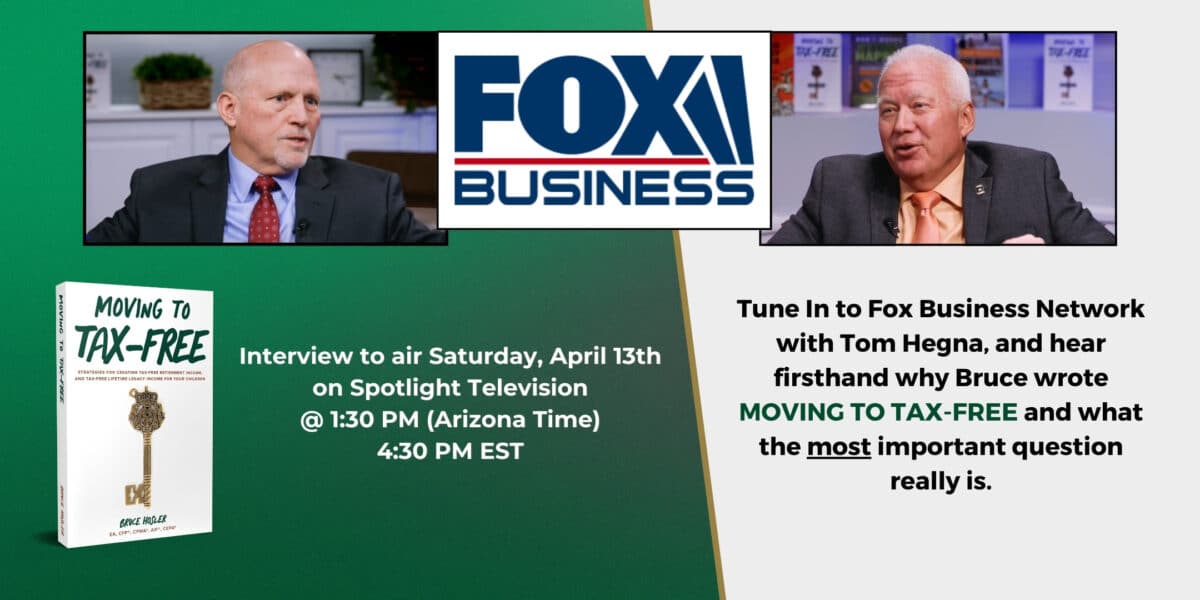

FOX BUSINESS NETWORK INTERVIEW – Bruce Hosler

Tune In to Fox Business Network for a Half Hour with Bruce Hosler Founder of Hosler Wealth Management April is National Financial Literacy Month. Coming up on Fox Business on April 13, 2024, at 1:30 pm Arizona time, and 4:30 pm EST, Bruce Hosler the author of “Moving to Tax-Free.” The episode will be hosted by industry legend Tom Hegna.

Forbes Best-In-State Wealth Advisor List In Arizona for 2024 – Bruce Hosler

7th Consecutive Year – Bruce Hosler is awarded Forbes Best-In-State Wealth Advisor List for 2024 in Arizona. As the founder of Hosler Wealth Management and with over 27 years of experience in financial planning, Bruce has been instrumental in helping clients navigate through some of the most challenging market cycles in history. His philosophy of providing exceptional client service is

#43 | MOVING TO TAX-FREE™ Bruce’s New Book

MOVING TO TAX-FREE by Bruce Hosler

Wealth advisor Bruce Hosler, EA, CFP®, CPWA®, AIF®, CEPA® brings a new approach to moving to a tax-free retirement. Based on Bruce’s decades of experience in wealth management and tax planning, this definitive guide is a strategic plan for how you and your family can pay less taxes over your lifetime. Using sound and intentional tax strategies, start to